Retirement Standard

Australia’s benchmark guide to how much money you need in retirement, helping you make the best decisions for your future after work.

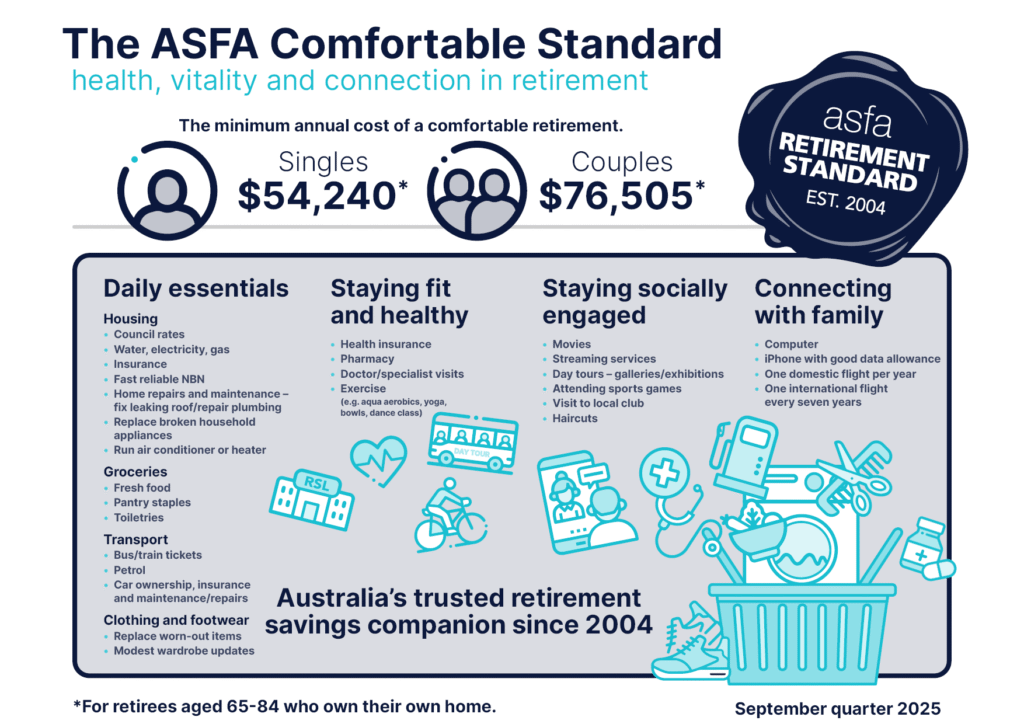

The ASFA Retirement Standard is Australia’s trusted retirement savings companion, providing a breakdown of estimated expenses for both comfortable and modest lifestyles, for couples and singles to maintain a healthy, vital and connected lifestyle in retirement.

Updated quarterly, the Retirement Standard provides a guide to weekly and annual expenses, helping Australians plan effectively for their retirement.

The ASFA Retirement Standard Explainer complements this by showing the superannuation balances needed to retire at 67, and how they are calculated.

How much super do I need?

The ASFA Retirement Standard is Australia’s benchmark guide to how much you need to spend in retirement. For 20 years it has provided a comprehensive breakdown of expenses for both comfortable and modest lifestyles, for couples and singles. These expenditures support a healthy, vital and connected lifestyle in retirement.

Budgets for various households and living standards for those aged 65-84 (September quarter 2025)

| Comfortable lifestyle | Modest lifestyle | Modest lifestyle (renters) | Age Pension | |

|---|---|---|---|---|

| Single | $54,240 a year | $35,199 a year | $49,676 a year | $30,646 including supplements |

| Couple | $76,505 a year | $50,866 a year | $67,125 a year | $46,202 including supplements |

| Top level private health insurance, doctor/specialist visits, pharmacy needs | Basic private health insurance, limited gap payments | Basic private health insurance, limited gap payments | No private health insurance | |

| Fast reliable NBN, computer and iPhone with good data allowance/streaming services | Fast reliable NBN, computer and android mobile, modest mobile internet data allowance | Fast reliable NBN, computer and basic android mobile, modest internet data allowance | Very basic mobile and limited internet connectivity | |

| Own a reasonable car, car insurance and maintenance/upkeep | Owning a cheaper, older, more basic car | Owning a cheaper, older, more basic car | Limited budget to own, maintain or repair a car | |

| Regular leisure activities including club membership, cinema visits, exhibitions, dance/yoga classes | Infrequent leisure activities, occasional trip to the cinema | Infrequent leisure activities, occasional trip to the cinema | Rare trips to the cinema | |

| Home repairs, updates and maintenance to kitchen and bathroom appliances over 20 years | Limited budget for home repairs, household appliances | Modest one or two bedroom apartment in a middle to outer ring suburb | Struggle to pay for repairs, such as leaky roofs or major plumbing problem | |

| Regular professional haircuts | Budget haircuts | Budget haircuts | Less frequent haircuts, or self-haircuts | |

| Confidence to use air conditioning in the home, afford all utilities | Need to keep a close watch on all utility costs and make sacrifices | Need to keep a close watch on all utility costs and make sacrifices | Limited budget for home heating in winter | |

| Occasional restaurant meals, home-delivery meals, take-away coffee | Limited meals out at inexpensive restaurants, infrequent home-delivery or take-away | Limited meals out at inexpensive restaurants, infrequent home-delivery or take-away | Only local club special meals or inexpensive take-away | |

| Replace worn-out clothing and footwear items, modest wardrobe updates | Limited budget to replace or update worn items | Limited budget to replace or update worn items | Very basic clothing and footwear budget | |

| Annual domestic trip to visit family, one overseas trip every seven years | Annual domestic trip or a few short breaks | Annual domestic trip or a few short breaks | Occasional short break or day trip in your own city |

ASFA Retirement Standard

How much superannuation do I need to retire at 67?

Superannuation balances required to achieve a comfortable retirement

Savings required for retirement at age 67

| Couple | Single |

|---|---|

| $690,000 | $595,000 |

Superannuation balances required to achieve a modest retirement

Savings required for retirement at age 67

| Couple | Single |

|---|---|

| $100,000 | $100,000 |

Superannuation balances required to achieve a modest retirement when renting privately

Savings required for retirement at age 67

| Couple | Single |

|---|---|

| $385,000 | $340,000 |

All figures in today’s dollars using 2.75% AWE as a deflator and an assumed investment earning rate of 6 per cent. The fact that the same savings are required for both couples and singles at the modest level reflects the impact of receiving the Age Pension.

Note: The lump sum estimates prepared by ASFA take into account the receipt of the Age Pension both immediately and into the future. The Age Pension is adjusted regularly by either the increase in the CPI or by a measure of wages growth, whichever is higher. The ASFA lump sum figures are therefore not updated quarterly.

How much super should I have today?

Now you can be a super sleuth and gauge your superannuation balance journey. Simply enter your age and ASFA’s Super Balance Detective will show you how much super you should have today.